Fighting Climate Change and the Social Cost of Carbon

This Is the Tragedy of the Commons

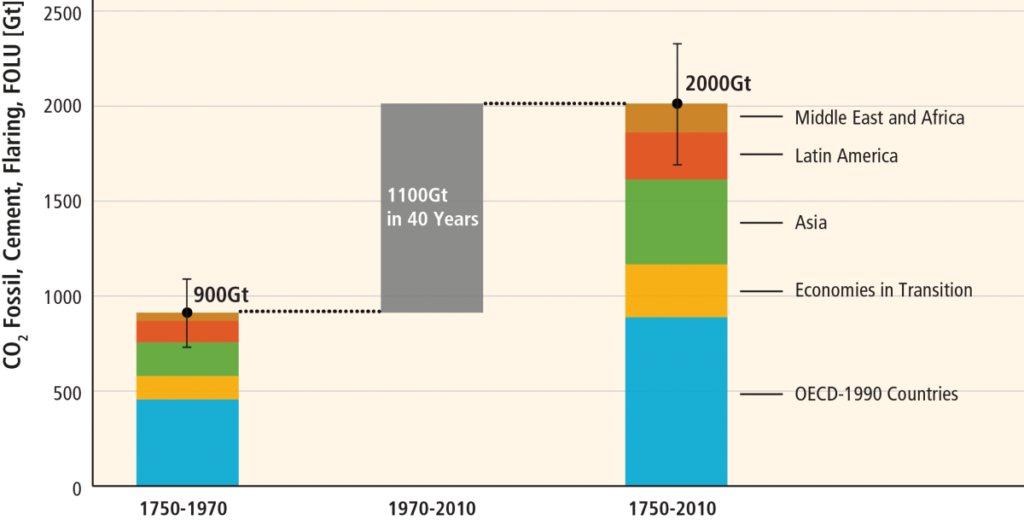

Despite the emergence over the last three decades of solid scientific information about the climate impacts of increased CO2 concentration in the atmosphere, the world’s emissions of Green House Gases (GHG) have risen (see Figure 1). This reality is due mainly to economic and population growth and to the dearth of actions to fight climate change.

Source: IPCC (2014)1

The 5th Report of the Intergovernmenal Panel on Climate Change1 estimates that by the end of this century, the average global temperature will increase by somewhere between 2.5°C and 7.8°C, after having already increased by almost 1°C over the last century. 2°C is the target that countries have agreed on since 2010, and the minimum point after which the scientific community considers catastrophic climate change inevitable. Limiting the increase in temperature to 2°C is an immense challenge. It will require radical transformations in the way we use energy, heat and locate our houses, transport people, and produce goods and services.

Yet, there has been little action due to the geographic and temporal dimensions of the climate problem. And the Paris Accord of December 2015 has not solved the problem.

Most benefits of mitigation are global and distant—they may go to other countries. While costs are local and immediate, the individual incentives for a country to act are negligible. Consequently, countries do not internalize the benefits of their mitigation strategies. The free-rider problem is well-known to generate the “tragedy of commons”.2

Carbon Leakages and Fossil Fuel Rents

A country or region that would contemplate a unilateral mitigation strategy would be further discouraged by the presence of the so-called “carbon leakages.” Namely, imposing additional costs to high-emission domestic industries makes them non-competitive. This tends to move production to less responsible countries, yielding an international redistribution of production and wealth with negligible ecological benefit. Similarly, the reduction in demand for fossil energy originating from the virtuous countries tends to reduce the international price, thereby increasing demand and emissions in non-virtuous countries. This other carbon leakage also reduces the net climate benefit of the effort made by any incomplete club of virtuous countries.

Its intertemporal version is called the green paradox, which states that a commitment to be green in the future leads oil producers to increase their production today to cater to today’s non-virtuous consumers. Since carbon sequestration is not a mature technology, mitigation is a threat to the fossil fuel producers. They should be expected to react to this threat.

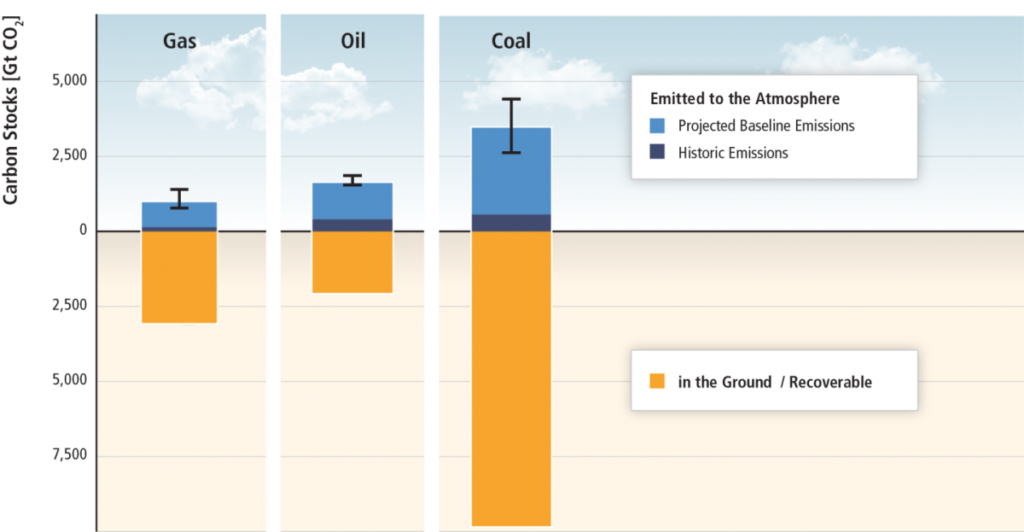

Eliminating or reducing oil and other fossil fuel rents is one of the most difficult challenges. This challenge comes from the existence of large fossil fuel reserves and their associated revenues in resource-rich countries (see Figure 2). In a business-as-usual scenario, burning the entire stock of fossil resources on this planet within the next two centuries or so would certainly devastate our planet by raising GHG concentration way above acceptable limits. If an efficient and credible climate policy would be one day implemented, this would imply the annihilation of fossil fuel rents and the consequent generation of an economic surplus for society.

Source: IPCC (2014)1

The political economy of climate change, however, is unfavorable: the costs of any such agreement are immediate whereas most benefits will occur in the distant future—mainly to people who are not born yet and a fortiori do not vote. In short, climate mitigation is a long-term investment. Why would countries sacrifice the consumption of goods and leisure to be environment-friendly? The reality is bleaker, in particular for economies in crisis and in the developing world. Fighting climate change diverts economic growth from consumption to investment, not good news for the wellbeing of the current poor.

Countries may act when they perceive some limited “co-benefits” of climate-friendly policies. For example, green choices may also reduce emissions of other pollutants (coal plants produce both CO2 and SO2, a regional pollutant) and could have enormous health, sanitary, and environmental benefits. Some actions are to be expected from countries with an eye on national interest only, but those will be far insufficient to generate what it takes to keep global warming manageable.

Overall, fighting climate change yields short-term collective costs, thereby creating a political problem for benevolent decision-makers who support an ambitious international agreement. It is collectively efficient to act, but individually optimal to do little.

Uniform Carbon Price: An Optimal Solution

The core of the climate externality problem is that economic agents do not internalize the damages that they impose on other economic agents when they emit GHGs. This is a free-rider problem. Economists have long proposed that the solution lies in inducing economic agents to internalize the negative externalities that they impose when they emit CO2 (“polluter pays principle” or economic approach). This is done by pricing emissions at a level that corresponds to the present value of the marginal damage, and by forcing all emitters to pay this price. The resulting price is the implicit price of carbon. All tons of CO2 should be priced equally as GHGs generate the same marginal damage regardless of the emitter and of the nature and location of the polluting activity. If all countries adopt the same carbon price, emitters have the incentive to implement the least-cost actions to abate CO2 emissions. Otherwise, they would have to pay the carbon price for those emissions. This least-cost approach guarantees that the reduction of emissions will be made at minimum global cost.

In contrast to this economic approach, Western countries have made some attempts at reducing GHG emissions, notably through direct subsidization of green technologies: generous feed-in electricity tariffs for solar and wind energy, fuel efficiency standards, subsidies to the biofuel industry, etc. These “command-and-control” approaches are not based on actual pollution and usually create wide discrepancies in the implicit price of carbon put on different emissions. In the electricity sector, OECD3 estimates that these implicit prices vary widely across countries ranging from less than $0 to $900. In the road transportation sector, the implicit carbon price can be as large as $1,000, in particular for biofuels.

This high heterogeneity of implicit carbon prices is inefficient and has been shown empirically to lead to substantial increases in the cost of environmental policies. Similarly, any global agreement that would not include all world regions in the climate coalition would exhibit the same inefficiency by setting a zero carbon price in non-participating countries.

Command-and-control policies should best be avoided, although occasionally, they are a second-best solution, easier to implement when direct pricing is complex and/or when consumers discount the future too much.

Income inequality is also an important issue linked to uniform carbon pricing. How should we allocate climate mitigation burden? The Kyoto Protocol suggested exonerating non-Annex 1 (those countries that did not commit to the aim of reducing GHG emissions) from carbon pricing. The Clean Development Mechanism (CDM) in the Kyoto Protocol was designed to alleviate the imperfect coverage problem; it met with limited success and was not a satisfactory approach due to yet another leakage problem. For example, a participating country paying to protect a forest in a less developed country unintentionally increases the price of goods the forest would have provided (beef, soy, palm, or wood) and encourages deforestation elsewhere. The CDM mechanism also created the perverse incentive to build, or maintain in operation longer than planned, polluting plants in order to later claim CO2 credits for their reduction.

Implementing a Carbon Price: Cap and Trade

The best way to implement a uniform price of carbon is the so-called cap-and-trade strategy. Under this solution, the agreement would specify a worldwide, predetermined number (the cap) of tradable emission permits. The tradability of these permits would ensure that countries face the same carbon price, emerging from mutually advantageous trades on the market for permits; the cross-country price would not result from an agreed upon price of carbon, but rather from the price determined by the demand and supply of emission permits. To address compensation, permits would be initially allocated to the different countries or regions, with an eye on getting all countries on board (redistribution).

The cap-and-trade system was adopted, albeit with a flawed design, by the Kyoto Protocol. Sadly enough, the Kyoto Protocol was a failure. Non-participating countries benefited from the efforts made by the participating ones, both in terms of reduced climate damages (free-rider problem), and in terms of improved competitiveness of their carbon-intensive industries (carbon leakage). Kyoto participants covered more than 65% of global emissions in 1992 but less than 15% in 2012.

The main attempt to implement a carbon pricing mechanism within the Kyoto agreement emerged in Europe, with the EU Emission Trading Scheme (EU ETS). Its initial design evolved to reduce emissions of the industrial and electricity sectors of the Union; however, the demand for permits has decreased over the years. The use of Kyoto offsets (mostly from the CDM) for compliance, the deep economic crisis that hit the region during 2008 and 2009, and the large subsidies in the renewable energy sector are among the reasons for this decrease. Absent any countervailing reaction on the supply of permits, the carbon price went down from a peak of $36/tCO2 to around $6.5- $9 /tCO2 today. This recent price level is without any doubt far below the social cost of carbon. It therefore has a limited impact on emissions. And worse, it allows electricity producers to substitute gas with coal*, which emits 100% more carbon (not counting dirty micro particles) per kWh.

*In Germany for example, gas was displaced by coal after the closure of nuclear plants

**Since early 2014, this market is linked to a similar one established by the Province of Québec.

During the third trading period (2013-2020), the EU-wide cap on emissions was reduced by 1.74% each year. The EU also began a progressive shift toward auctioning allowances instead of allocating them (a cost-free approach). It is expected that this shift will improve the efficiency, transparency, and simplicity of the system. Auctioning will also eliminate windfall profits, which arise when operators charge their customers the cost of allowances they have received for free.4

Over the last three decades, Europeans have sometimes believed that their (limited) commitment to reduce emissions would motivate other countries to imitate their proactive behavior. That hope never materialized. Outside the Kyoto Protocol, the US, Canada, and China established some regional cap-and-trade mechanisms. In the US, two initiatives are worth mentioning. In the Regional Greenhouse Gas Initiative (RGGI), nine Northeast and Mid-Atlantic US states created a common cap-and-trade market to limit the emissions of their electricity sector. Here also, the current carbon price is way too low, at around $5 /tCO2 (up from the price floor level of $2 /tCO2 during the period 2010-2012). Over the period 2015-2020, the CO2 cap will be reduced by 2.5% every year. The system will release extra carbon allowances if the carbon price on the market exceeds $6 /tCO2. A similar system exists in California to cover the electricity sector, including large industrial plants and more recently fuel distributors, thereby covering more than 85% of the state’s emissions of GHGs**. The current price of permits in California is $12/tCO2, at the minimum legal price. This fragmented scheme illustrates the strange economics of climate change in the US, where the minimum carbon price in California is larger than the maximum carbon price in RGGI. In 2014, China has established 7 regional cap-and-trade pilots, officially to prepare for the implementation of a national ETS scheme.

The fragmented cap-and-trade systems described above cover almost 10% of worldwide emissions, and observed price levels are too low to generate meaningful GHG savings. This is another illustration of the tragedy of commons

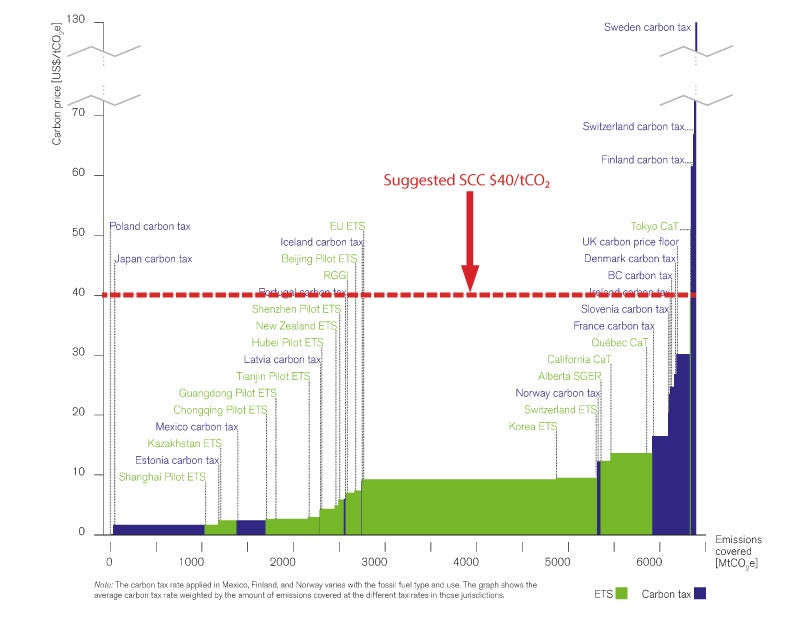

Some countries have implemented a carbon tax (see Figure 3). The most aggressive of these taxes is in Sweden, where a carbon tax of approximately $131/tCO2 was implemented in 1991. France has fixed its own carbon tax at $19/tCO2. Both of these taxes are used for various purposes, such as raising revenue or addressing congestion externalities and road safety. They also can be used to comply with an international commitment to cap-and-trade or to a carbon price. Except for the Swedish case, these attempts assign a carbon price that is far too low compared to the SCC (see Figure 3). As I explain in the second digest of this series, SCC should be close to $40/tCO2.

Source: World Bank (2015)

5 SCC from author (See Digest: Computing the Right Price Signal for the Social Cost of Carbon)

Conclusion

Last December, the COP21 Paris buried the possibility of a universal price of carbon amid splendid general indifference. In spite of the mounting evidence about global warming, international mobilization has been most disappointing. The Kyoto protocol and the Paris agreement failed to build an international coalition supporting a carbon price in line with its social cost. This failure illustrates the intrinsic instability of any international agreement that does not seriously address the free-rider problem. An international agreement must satisfy three properties: economic efficiency, incentive compatibility, and fairness. Efficiency can be attained only if all countries face the same carbon price. Incentive compatibility can be attained by penalizing free riders. Fairness, a concept whose definition differs across stakeholders in the absence of a veil of ignorance, can potentially be reached through lump-sum transfers.

This digest has been inspired from Gollier and Tirole (2015).6

Christian Gollier

- IPCC, (2014), Climate Change 2014: Mitigation of Climate Change, Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx (eds.)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA. [↩]

- Hardin, G., (1968), “The Tragedy of Commons”, Science 162 (3859): 1243-1248. [↩]

- OECD, (2013), Climate and Carbon: Aligning Prices and Policies, OECD Environment Policy Paper 1, OECD Publishing, Paris. [↩]

- European Commission, Climate Action, Questions and Answers: Auctioning and its regulation, http://ec.europa.eu/clima/policies/ets/cap/auctioning/faq_en.htm [↩]

- World Bank Group (2015), State and trends of carbon pricing 2015. [Kossoy, Alexandre; Peszko, Grzegorz; Oppermann, Klaus; Prytz, Nicolai; Klein, Noemie; Blok, Kornelis; Lam, Long; Wong, Lindee; Borkent, Bram] http://documents.worldbank.org/curated/en/2015/09/25053834/state-trends-… [↩]

- Gollier, C., and Tirole, J. (2015), Negotiating effective institutions against climate change, Economics of Energy and Environmental Policy 4, 5-27. [↩]